Little Known Facts About Paul B Insurance Medicare Insurance Program Huntington.

Wiki Article

Not known Facts About Paul B Insurance Medicare Supplement Agent Huntington

Table of ContentsSome Known Incorrect Statements About Paul B Insurance Medicare Part D Huntington What Does Paul B Insurance Medicare Part D Huntington Do?Excitement About Paul B Insurance Medicare Advantage Agent HuntingtonPaul B Insurance Medicare Part D Huntington for BeginnersLittle Known Facts About Paul B Insurance Medicare Health Advantage Huntington.

(People with particular specials needs or health and wellness conditions might be qualified before they transform 65.) It's created to safeguard the health and also well-being of those who use it. The 4 parts of Medicare With Medicare, it is very important to recognize Components A, B, C, as well as D each part covers details solutions, from healthcare to prescription medications.

If you're currently getting Social Safety advantages, you'll automatically be enrolled in Component An as quickly as you're eligible. Discover when to enroll in Medicare. You can obtain Component A at no cost if you or your partner paid into Medicare for at the very least 10 years (or 40 quarters).

The Ultimate Guide To Paul B Insurance Medicare Health Advantage Huntington

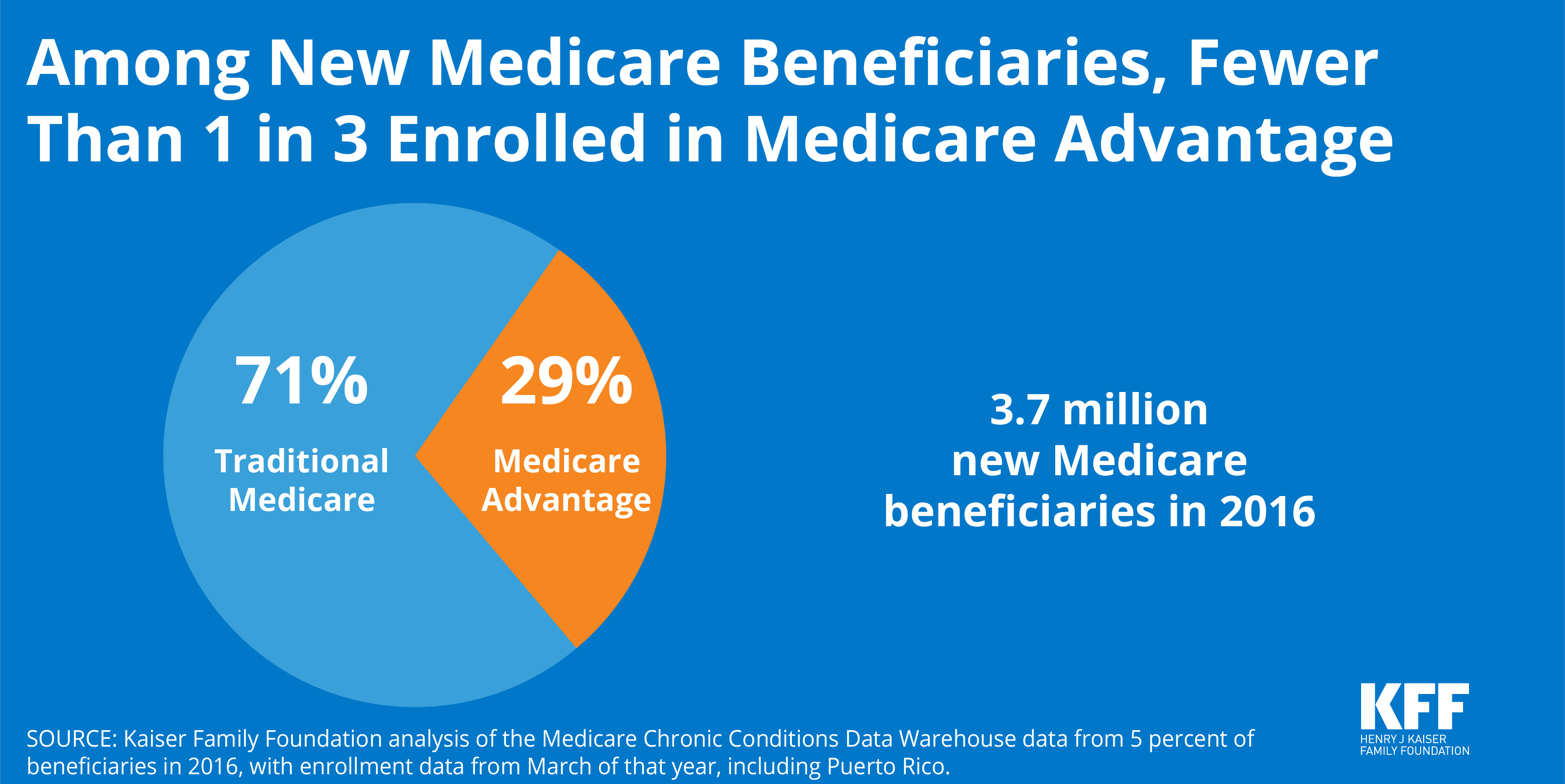

Medicare Advantage is an all-in-one plan that packages Initial Medicare (Part An and also Part B) with additional benefits. Kaiser Permanente Medicare health insurance are examples of Medicare Benefit strategies. You require to be signed up in Component B and eligible for Part A before you can sign up for a Medicare Advantage plan.

Prior to we talk concerning what to ask, allow's speak about that to ask. For many, their Medicare trip begins directly with , the official internet site run by The Centers for Medicare as well as Medicaid Services.

Little Known Facts About Paul B Insurance Medicare Insurance Program Huntington.

It covers Part A (health center insurance) as well as Component B (clinical insurance coverage). These strategies work as a different to Initial Medicare, integrating the protection choices of Parts An as well as B, as well as added advantages such as dental, vision as well as prescription drug coverage (Component D).Medicare Supplement strategies are an excellent enhancement for those with Original Medicare, helping you cover expenditures like deductibles, coinsurance and also copays. After obtaining treatment, a Medicare Supplement plan will certainly pay its share of what Original Medicare really did not cover after that you'll be accountable for whatever remains. Medicare Supplement plans usually don't include prescription medicine insurance coverage.

You article can enlist in a different Component D strategy to include medicine insurance coverage to Original Medicare, a Medicare Expense strategy or a few various other kinds of strategies. For lots of, this is often the initial concern taken into consideration when looking for a Medicare plan. The price of Medicare differs depending on your healthcare requirements, financial support qualification and also how you choose to obtain your benefits.

The smart Trick of Paul B Insurance Medicare Agent Huntington That Nobody is Talking About

For others like seeing the doctor for a lingering sinus infection or filling amerigroup medicaid up a prescription for protected antibiotics you'll pay a cost. The amount you pay will certainly be different depending upon the sort of plan you have and whether you've looked after your deductible. Medicine is an integral part of care for many individuals, particularly those over the age of 65.and also seeing a supplier that accepts Medicare. But what regarding taking a trip abroad? Several Medicare Benefit plans supply global protection, in addition to protection while you're taking a trip locally. If you intend on taking a trip, make certain to ask your Medicare advisor about what is and isn't covered. Perhaps you have actually been with your present physician for some time, as well as you desire to keep seeing them.

Many individuals that make the switch to Medicare continue seeing their regular doctor, but for some, it's not that easy. If you're dealing with a Medicare advisor, you can ask them if your medical professional will certainly be in network with your new strategy. If you're looking at strategies separately, you may have to click some web links as well as make some phone calls.

Some Known Facts About Paul B Insurance Medicare Advantage Plans Huntington.

gov internet site to seek out your existing doctor or an additional service provider, center or healthcare facility you wish to use. For Medicare Benefit plans as well click as Cost plans, you can call the insurance policy business to make certain the physicians you desire to see are covered by the strategy you want. You can additionally check the plan's site to see if they have an on-line search device to locate a protected physician or clinic.Which Medicare plan should you go with? That's the very best component you have alternatives. And also inevitably, the selection depends on you. Bear in mind, when obtaining started, it is very important to make certain you're as educated as feasible. Beginning with a list of considerations, make certain you're asking the appropriate inquiries as well as begin concentrating on what kind of strategy will certainly best offer you and your needs.

Medicare Benefit plans are exclusive insurance policy policies that aid with the voids in Medicare protection. Although they seem similar to Medigap plans, don't confuse the two, as they have some significant differences. To be eligible for Medicare Benefit registration, you must first enroll in Original Medicare (Medicare Component An as well as Part B).

Report this wiki page